Απόσπασμα από το βιβλίο Α Political Economy of Contemporary Capitalism: Demystifying finance, των Σωτηρόπουλου-Μηλιού-Λαπατσιώρα, σελ. 110-111. Το αρχείο σε pdf μπορεί να βρεθεί εδώ.

The theoretical sketch that we have tried to put forward does not solely approach the study of financial mechanisms (financialization) from the view point of their “productive” or “counter-productive” effects (finance as a process of funding) – but situates the phenomenon of financialization in a whole series of “positive” effects in the organization of capitalist reality, even if these effects seem marginal at first sight. We believe that this second category of effects, that remain to some extent latent in the whole process, is the most decisive precondition for the circuit of capital and the reproduction of social power relations in general. In this regard, financialization is grasped a complex technology for the organization of capitalist power, the main aspect of which is not income redistribution and economic instability, but the organization of capitalist power relations in line with a particular prototype. This process in motion encompasses different institutions, social procedures, analyses and reflections, calculations, tactics, and embedding patterns that allow for the exercise of this specific, albeit very complex, function that organizes the efficiency of capitalist power relations through the workings of financial markets…

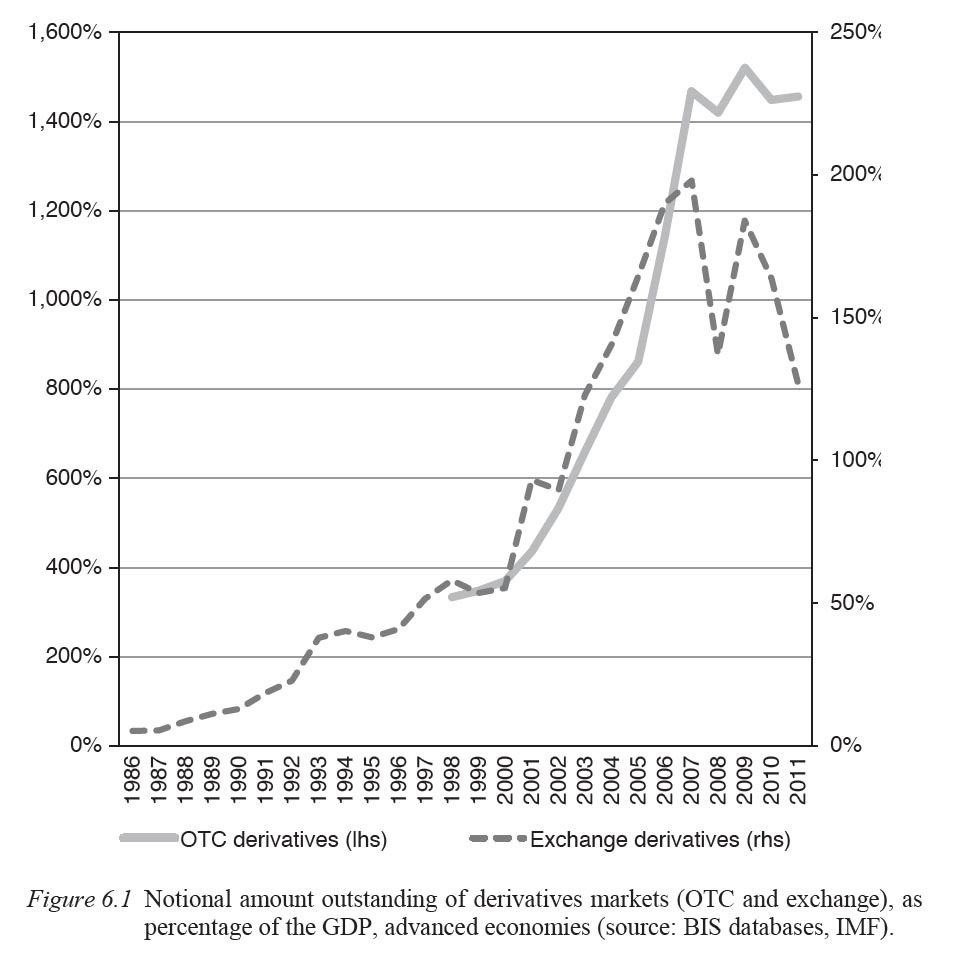

Derivatives are the epicenter of contemporary finance… In the derivatives statistical data (as they are collected by the Bank for International Settlements: BIS), the size of derivatives markets is measured by the gross nominal or notional value of all deals concluded and not yet settled on the reporting date for several types of products (not all the products of the so-called structured finance). This is the notional amount outstanding. Figure 6.1 depicts the trend of this variable after 1998 for OTC and organized transactions (as it is quite clear, the first type of market overwhelms in the derivatives dealing). It is straightforward to realize that the expansion of the derivatives market is considerable and remarkably stable. The total size of both markets exceeds the 1,000 percent of world GDP or alternatively the 1,500 percent of the GDP of advanced capitalist economies.

Looking at Figure 6.1, one cannot escape from the following question: how can the above trend be explained and what are its consequences for the organization of capitalist power and social life in general? This question is closely related to another: Why hasn’t economic and social research highlighted the importance of this trend? The majority of the researchers who embark upon the study of contemporary financial engineering, resort to speculation as the ultimate basis of their explanation. But then, how many times should the size of these markets overstep world GDP in order for us to realize that something else is going on?